< 1 min read

December 19, 2012

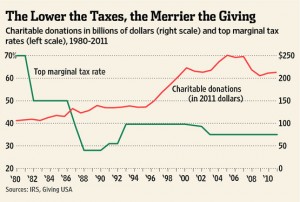

Of course, that graphic also tells a more general story about America's rising prosperity during those same years. Dennis says that there is a direct relation between the top marginal rate and economic growth. That's surely true, although I'm not sure that in terms of economic growth allowing the top rate to go to 39.6% would be a total catastrophe -- at least, not more of a catastrophe than the one represented by our knee-buckling national debt. But that's a different argument. In any case, nonprofits and their lobbyists -- or, more importantly, their funders -- would do well to consider Dennis's argument with care.

Jeremy-

Thanks for bringing that to our attention.