While giving cash directly to strangers is an act as ancient as almsgiving, recent uses of technology by philanthropic organizations have created a new playing field.

"Direct cash transfers" have become a trendy topic in philanthropic circles recently. Yet the question of their effectiveness is not a new one: do I hand the $5 bill to the man on the street corner, or is the risk too big that my generosity will in fact “hurt” him?

While giving cash directly to strangers is an act as ancient as almsgiving, recent uses of technology by philanthropic organizations have created a new playing field.

Philanthropy Daily reported on this trend a year ago: the mantra of “maximum efficiency” upheld by systems-level philanthropic programs for years has backfired in the wake of new research findings.

A report from the Center for Global Development and the Overseas Development Institute in 2015 stated that “cash transfers are among the most well-researched and rigorously-evaluated humanitarian tools of the last decade,” naming them the “‘first best’ response to crises.”

Providing funds directly to those in need had proven itself over decades to be the most effective way of meeting those needs. Without the mediation of organizations determining people’s needs, monetary gifts are both more flexible and cheaper to deliver. People will spend their money on what they actually need, and they will get the complete cut of that money.

The counter-argument to this should be obvious, as it is the very argument upon which large philanthropic organizations have staked their claims of preeminence for over a century: people cannot be trusted to spend money in ways that will truly help them out the most.[1]

But decades of research tell a different story. According to the Center’s report, a World Food Programme project in Ethiopia provided both cash and food to residents, and found that the cash gifts were more efficient than the food aid by 25-30%.

The people in those crisis situations agree: an International Rescue Committee project in Lebanon found that 80% of people preferred cash to any other form of aid.

According to the report’s research on crisis situations in Ecuador, Niger, Uganda, and Yemen, 18% more people could have been aided, at no extra cost, if everyone had been given cash rather than food.

In a recent article at The Atlantic Benjamin Soskis points out that the rise in direct cash giving places “the onus on donors, big and small, to defend the priority of their own humanitarian prerogatives against those of the people they seek to help.”

To test if an organization is really helping out a particular person or group of people in the most efficient way, it is becoming easier for someone to simply give their own money directly and compare the results.

The ease, Soskis writes, and the consequent trend, of people transferring cash to those in need directly, has provided a new “benchmark” for the effect of the money donated: the operation of big-name charities, which have for decades operated behind a necessary veil of trust, can now be compared to the effectiveness of a direct donation. While this might not be feasible on an individual level, the rise of this sort of giving on a large scale makes the task of comparison actually feasible, as the Center for Global Development’s report demonstrates.

While modern technology in the charitable sphere is not without its shortcomings (read here and here), it seems that this is a place where it actually provides a great advantage.

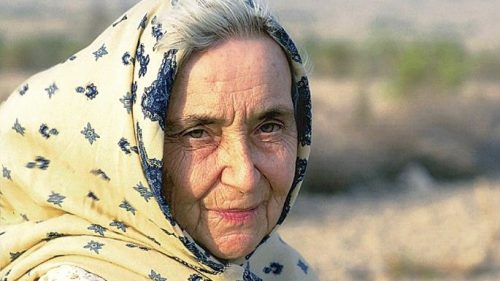

The service of GiveDirectly is a bright example of this: anyone can get on the site and instantly donate, directly, to a person in need. That person can then post real-time updates of the ways in which that money is changing their lives. Digital payments make the transfer and distribution of cash much cheaper, more immediate, transparent, traceable, and secure.

In short, donors can rely less and less necessarily on the mediation of either a philanthropic organization with its own vision and goals, or the reports of scientific research with its own definitions of “efficiency.” Givers can confirm reports like that of the CGD with their own experience, tearing down the narratives of systematic, max-efficiency giving that have disparaged the act of individual charity for too long.

And this form of giving can only gain a stronger foothold as digital cash transfer apps like Venmo and Cash App become more popular forms of currency exchange, especially among millennials. If this shift has done anything to change the nature of giving, it has made transferring money to someone else digitally feel exactly equivalent to handing that person a handful of paper dollars: or, for many, replaced that feeling. The only difference is, now direct “handing” can happen, instantly, across continents.

As Soskis points out, direct giving is not truly a revolution in charity, but a return to the way in which charity was practiced for centuries: the difference being that, traditionally, individual gifts of charity were supported by argument of morality, not of efficiency.

Perhaps the focus on efficiency that underlies this trend of direct cash transfer makes the future of this trend questionable: the tides might turn back when a new report comes out in a decade with a different conclusion.

Or, perhaps, technology has developed to a point where it can temper the illusions it has cast in previous decades. Perhaps it is beginning to confirm the effectiveness of what had been established for centuries as both a moral and a civic good: a gift freely given from one human being to another in need.

[1] In 1889 Andrew Carnegie, the father of modern philanthropy, wrote an essay titled “The Gospel of Wealth,” in which he argued against what he called “indiscriminate almsgiving,” saying that it would be “better for mankind that the millions of the rich were thrown into the sea than so spent as to encourage the slothful, the drunken, the unworthy.”