Readers of Philanthropy Daily have recently seen a series of articles exchanging different perspectives on the tax-exemption of endowments at elite private colleges, including my own Endowments on the table: why should taxpayers subsidize elite private colleges?, Schneider and Klor de Alva’s Taxpayers are over-subsidizing rich nonprofit colleges, and Sean Parnell’s response to both articles, Attacks on university endowments are misguided.

Sean Parnell’s response raises some important points, but also seeks refuge behind some sleight-of-hand. The key issues, it seems, are:

- whether endowments themselves are characteristic of nonprofit activity,

- and questions of scale (at what point does accumulated wealth tip over into profiteering?)

Parnell argues that government taxation of endowments would create a “dangerous precedent” that would weaken the “guardrail” between government and civil society and would further put government in the business of making distinctions between worthy and unworthy forms of charity. These are substantive concerns and require some reflection.

Charitable giving and nonprofit associations have long been the backbone of American civil society, and are central to the American scheme of liberty. They help maintain a vibrant civil society that lessens the need for government action and provides meaningful opportunities for public engagement. Their critical contributions to the public weal testify to the limits of government as well as the capacity of citizens to take care of each other.

Tax-exemptions of charitable giving and nonprofit organizations reflect the long-standing sense of the importance of religious freedom in its full expression and relate to the belief that individuals need incentives to help fund these organizations. But one plays with this at peril. Not all civil institutions enjoy tax-exemption. The family, the bedrock of social life, does not.

The longstanding assumption behind tax-exemption relates, on the one hand, to the conviction that these organizations contribute to the common good or, on the other, that they have a status grounded in either constitutional exemptions or historic practices. For the latter reasons, religious organizations carry special weight. And the tax-exemption of colleges undoubtedly relates, historically speaking, to their initial religious purposes, a fact Parnell elides. Instead, he hinges his rebuttal on the first-prong of organizational exemption: contributions to the common good.

Here, however, Parnell’s claims are offered without evidence. While it is undoubtedly the case that these schools make some contribution, it is not at all clear that it is sufficient to justify what is, Parnell notwithstanding, a tax subsidy, as my original article demonstrated. Nor is it clear that even if the public benefits supersede the public costs that such can justify the continued build-up of multi-billion dollar hedge funds, which remain distinct from the contributions themselves. In any case, references to “scientific research” and “tuition assistance” have a vaporous quality that settles like a fog obscuring the outlines of the issues. For example, schools are patents holders for which they receive remuneration, which brings them closer to a typical for-profit business model, particularly when you throw in government grant money.

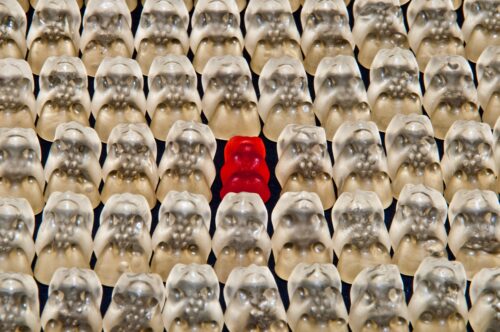

Also, there is a clear differentiation to be made between giving/receiving money, which seems worthy of exemption, and hoarding it. Parnell never really tells us why a school needs such a large endowment, nor does he address its implications for advancing the interests of elite schools over non-elite ones. He seems to assume that what is good for the elites is good for America. The multi-billion dollar endowments still do little more than further elite dominance of American life, a fact Parnell seems more comfortable with than I am. They also have ways of obscuring institutional missions, as they become more interested in maintaining their wealth than doing things such as educating students. Indeed, it is not atypical for the rich to insure the well-being of their own children through legal machinations while providing sops such as financial aid that look like generosity, as David Brooks recently argued.

Parnell is concerned that addressing endowments will necessarily involve government privileging certain kinds of giving, or certain kinds of groups over others. Yet anyone who has worked in the nonprofit world knows that government already does that, and defers more readily to certain organizations than others (not even raising the specter of the IRS scandal). Furthermore, government can hardly avoid, if it is in the tax-exemption business, asking determinations about eligibility. While I am loathe to give government more power, I fail to see how Parnell’s concerns amount to an expansion of powers government already exercises. In fact, not exercising such discretion may well have an unbalancing effect on civil society, as I argued initially.

The revolving door between hedge fund operations and university endowments hardly seems like classic “non-profit” activity since the very purpose of management is solely to increase the endowment’s value, and these increases are not taxed. The compensation system for managers and their subsequent contributions to endowments are, as I argued, sufficiently suspect to warrant review.

I return to how I started my first article: Gladwell’s claim that no sane person should give money to Princeton. And yet they do, and that fact alone should arch an eyebrow.

Not surprisingly, I don’t find Professor Polet’s reply to my earlier piece all that persuasive or even accurate. I’ve written up a fuller response at the blog of the Alliance for Charitable reform, here: http://acreform.org/blog/attack-university-endowments-undermine-philanthropic-freedom/

Key paragraph (or at least I think so):

“Polet dismisses my primary concern that his and similar efforts would establish a “hierarchy of giving” with politicians and bureaucrats picking winners and losers across civil society, saying that “government can hardly avoid, if it is in the tax-exemption business, asking determinations about eligibility.” But what is being proposed goes well beyond the simple requirements to be recognized as a charitable organization that exist today (the three main tests require that no profits be distributed to shareholders or employees, expenditures on lobbying are limited, and intervention in political campaigns is strictly prohibited). What is being sought instead is to treat organizations with identical missions engaged in identical work differently based on subjective notions of when some institutions have “too much” money or a disfavored demographic profile.”