Over the past century, there have been two schools of thought in fighting poverty. The left would argue the primary reason people are poor is a lack of money. Given them enough money—say, through a $15 an hour minimum wage—and you’ve conquered poverty.

The right would counter that the poor primarily stay that way through a lack of morality. Drug abuse, single-parent households, and bad work habits condemn the poor to a life at the bottom of the income ladder. Their argument, most forcibly expressed in the American Enterprise Institute’s 1987 monograph The New Consensus on Family and Welfare, is that if poor people graduate high school, and get and stay married, they will take the first steps that will enable the poor to escape the poverty trap.

Occasionally the two fighting schools of poverty cooperate. For example, as historian Linda Gordon has observed, the 1935 law that in one section created Social Security and in another created welfare had something for everyone; Social Security, in her view, was largely a creation of men who thought people needed to be “insured” against degradation, while welfare was the creation of women who wanted aid to go to “deserving” women and children, through restrictions that gradually dissolved by the 1960s.

But what if both sides were wrong? What if there were other, hidden factors that kept the poor mired in poverty? That is the thesis of Harvard economist Sendhil Mullainathan, whose views are ably summarized by Cara Feinberg in Harvard Magazine.

Mullainathan, whose research is summarized in the 2013 book Scarcity: Why Having Too Little Means Too Much (co-written with Princeton psychologist Eldar Shafir), believes that people who don’t have much money tend to think about money all the time. They then begin to react in bad ways, such as frequenting “payday loan” companies that sock their customers with massive interest rates. They fail to work in school, ensuring they drop out or barely graduate. The result is the poor struggle to accumulate capital and remain poor.

Mullainathan’s touchstone is an experiment conducted during World War II, when thirty-six students at the University of Minnesota volunteered to starve themselves so that researchers could tell the Allied generals how the hungry civilians they would face in Germany would react to soldiers from the West. They found that as the research subjects’ calorie counts dwindled, all the test subjects could think about is food. “Men with no previous interest in food thought—and talked—about nothing else.”

It’s Mullainathan’s argument that the same thing happens to poor people. All the time poor people think about money is a “bandwidth tax” that punishes them.

As evidence, he led a group of researchers to a shopping mall in New Jersey and administered an IQ test called Raven’s Progressive Matrices to a group of rich and poor people. Before the subjects started, they were told that their cars had broken down and it would cost $3,000 to fix the car, of which auto insurance would pay half. Would it be better to come up with the $1,500, or to hang on with the ailing car and hope it wouldn’t collapse? The rich people didn’t worry about this, but the poor ones had their IQ points fall by fourteen points—equivalent to staying awake for twenty-four hours.

A second experiment had the rich and the poor play a version of “Family Feud.” But the rich were given more time than the poor to answer questions, but the poor could “borrow” time from future rounds. As the rounds progressed, the poor kept borrowing time they couldn’t repay, so they had shorter rounds, ensuring they would lose the game again and again.

Suppose the evidence of Mullainathan and his colleagues is true. How would this affect social policy?

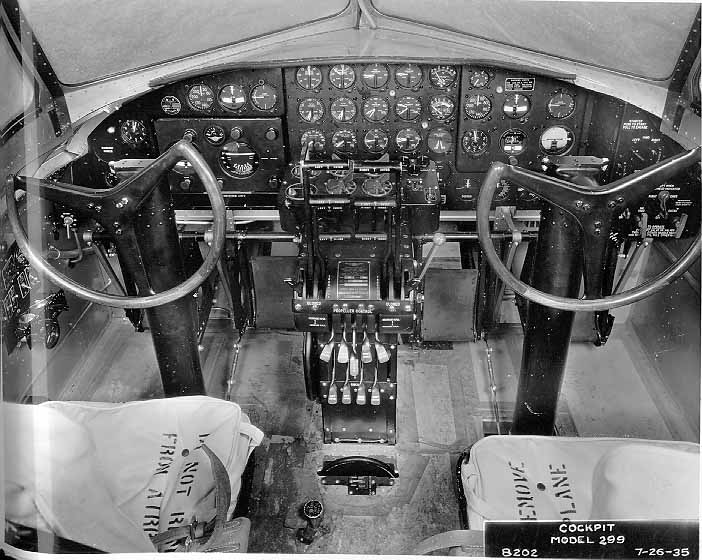

In their book, Mullainathan and Shafir use another lesson from World War II. A large number of bombing crashes were caused by the pilots of B-17 and B-25 airplanes, who would pull the wheels up during a landing instead of the flaps, causing crashes. Engineers found the controls for the wheels and flaps were similar and located next to one another. So they put a small rubber wheel on the wheel control and the crashes stopped.

Similar tweaks, Mullainathan says, could fix social policy. Here he reveals himself as an advocate of “nudge” behavioral economics, a school most famously represented by Mullainathan’s Harvard colleague Cass Sunstein and the University of Chicago’s Richard Thaler. As Feinberg notes, behavioral economics has proven quite popular; in 2010 the British government established a multiagency group to study behavioral economics in 2010, and the American government followed suit in 2014.

Mullainathan has established a think tank, Ideas42, to come up with behavioral economics projects to fund. (And yes, the “42” is a reference to the number in The Hitchhiker’s Guide to the Galaxy which supposedly is the answer to every question.) The group has attracted some big funders; the Gates and Lumina foundations have given money for education projects, while the Hewlett Foundation supported a conference on ”Innovations in Family Planning and Reproductive Health.”

But the “nudges” that these mighty thinkers have come up with are very small. The Cleveland Housing Network found that poor people paid their rent if they were mailed reminders to do so. Some people were less likely to take out big loans if the statements they were sent replaced “interest rates” with “dollars owed” on the forms.

Andrew Ferguson in the Weekly Standard wrote the best critique of behavioral economics I have read. Ferguson makes two major points. First, when behavioral economists say behavior is “irrational,” they never define what irrational means. It could mean any behavior of which the economist disapproves. Second, a great many experiments in behavioral economists are done on campuses, with test subjects students who need the money. Although Mullainathan and Shafir’s experiments seem to be based on larger samples, far too many behavioral economists extrapolate findings from pools or graduate or undergraduate students as representative of the general public.

To my mind, Mullainathan’s research has some interesting ideas, but fails to show how their research will help poor people get up, get to work, do their jobs, not scream at their bosses, and advance in life. It is quite possible that the jobs that will be created as a result of this research are in the behavioral economics industry, helped by foundations eager to support “new ideas” that reward well-connected scholars, but actually do little to help the poor advance in life.